![Why Is My Cash App Transfer Failed – [How to Fix]](https://www.digihubexpert.com/wp-content/uploads/2023/08/WHY-CASH-APP-TRANSFER-FAILED_15_11zon.webp)

Why Is My Cash App Transfer Failed – [How to Fix]

Are you worried about learning why Cash App Transfer Failed? If yes, it could be due to various reasons such as an outdated app, expired debit or credit card, insufficient balance, poor network connection, etc.

Thus, to resolve this issue, you need to check your account balance, use a proper internet connection, verify payment information, and use alternative payment options.

After going through all these fixes, if you still encounter any problems, you need to contact the Cash App team directly through their app or website. They will help you thoroughly by providing the possible instructions or guidance. For further information, explore the blog!

Why did Cash App Transfer Fail

Many users face transfer failure issues but need to know why. It can occur due to various reasons. Some of the common ones are prescribed below:

1. Poor Internet Connection:

Every transaction requires a strong Internet connection; thus, you must check network connectivity whenever you face a transfer failure problem. For the best result, connect your device to a reliable network.

2. Outdated Cash App:

An outdated version of the app leads to the transaction failure issue. So, you must update your app with the latest version and try to make a transaction.

3. Linked bank account:

You might face severe issues if you have not linked your bank account with the Cash App. Thus, it is recommended that you do so before attempting a transaction.

4. Inadequate funds:

Insufficient balance leads to problems with Cash App transfer failures. Thus, you must keep enough funds in your Cash App account while transacting.

These are the reasons users face Cash App Transfer Failed issues. Don’t worry; we’ve mentioned below some possible fixes to help you resolve them.

6 Methods to Fix Cash App Transfer Failed Issue

If the Cash App transfer has failed, you must follow the troubleshooting steps to resolve these problems. Thus, follow these processes carefully to avoid transfer failure issues:

1. Check your internet connection:

A poor internet connection might cause transfer failure problems. So, while making a transaction, ensure your device is connected to a stable internet connection.

2. Verify account information:

If your transfer has been unsuccessful, you need to check the details you entered to verify the transaction. This can happen for various reasons, such as server maintenance or a pending loan amount.

3. Update Cash App:

Transfer failure problems typically occur due to outdated software. To resolve this issue, updating your app is recommended. However, you can update the app from the Apple or Google Play Store.

4. Insufficient Funds:

Sometimes, insufficient balance results in transfer failure problems. In such a case, take action to prevent other financial losses. Hence, before transferring money, you must check the account balance; otherwise, the transaction will fail.

5. Use an alternative payment method:

If you’re having trouble with the Cash App, you should try using another payment method, such as Venmo or PayPal. Using alternative options might solve all your existing issues.

6. Contact Cash App Support:

If you cannot fix your issue using the above steps, contact the Cash App customer support team via the app or their website. They will help you to reverse the failed transaction.

How do I fix the Cash App payment declined due to “unusual activity”?

To fix the Cash App payment declined issue, you need to follow the below procedures:

- Open your phone settings

- Clear the cache of memories

- Ensure that date and time settings are saved correctly

- Double-check the network connectivity

- Now, update your phone software

- Next, update the Cash App

If you still have an issue, contact Cash App customer service. They will assist you by providing the proper guidance and instructions.

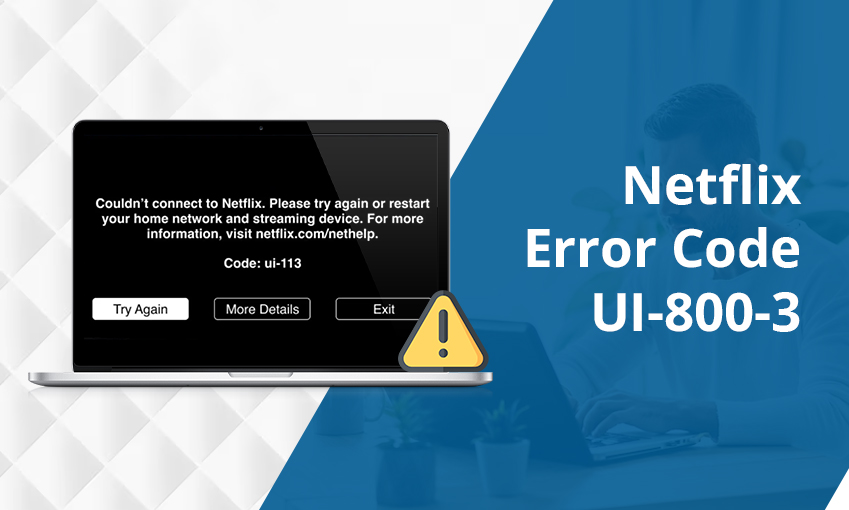

Why did Cash App payment fail for my protection

The Cash App finds the transaction suspicious if you see the “Cash App Transfer failed for your protection” message on your screen. Thus, if you make any fraudulent transactions, they could be automatically declined. This could happen if your zip code has changed or your card has been declined.

If your bank account is linked to Cash App, the app may consider this suspicious activity. Thus, to prevent these situations, you are advised not to exceed your limit when sending or receiving funds via the app.

If you cannot resolve your issue, you can try other methods, such as contacting your bank. Once you finish the provided steps, you can send and receive funds again.

Tips to fix the Cash App Transfer Failed issue in the future

You must go through the following tips to solve the transfer failure issues on Cash App:

- Ensure that you’ve sufficient funds in your Cash App account.

- Double-check the entered recipient’s information before transferring funds.

- Before sending funds, check the status of the recipient’s account.

- If needed, contact Cash App customer support for help.

The Final Verdict

Do you want to know why Cash App Transfer Failed and how to fix this issue immediately? Then, we advise you to read this entire blog. This usually happens due to insufficient funds, a poor internet connection, wrong payment information, etc. If you are still experiencing issues, contact the Cash App support Number, live chat, or social media.

Frequently Asked Questions

1. Why is my Cash App showing that the transfer failed?

If your Cash App shows a transfer failure issue, it could be due to various reasons, such as an insufficient balance, outdated app version, or unstable internet connection.

2. Why is my Cash App declining when I have money?

Cash App declined the transactions due to incorrect card information, such as CVV code, card number, billing address, or expiration date. It also happens because of outdated personal details. Hence, ensure that your account details are up-to-date.

3. What happens when a Cash App payment fails?

If Cash App shows a payment failure message, your money will be instantly returned to your linked bank account or Cash App balance. If not, it will be available in your account within 1–3 business days.

4. Why are my Cash App transactions not going through?

Payments show as completed but not received for several reasons, such as detected fraud, spam, typo error, insufficient funds, expired cards, or a poor network connection. Thus, verifying your account balance and updating the app is advised.

![How to Contact Netflix Customer Service – [5 Methods]](https://www.digihubexpert.com/wp-content/uploads/2023/12/How-to-Contact-Netflix-Customer-Service.jpg)